maryland tax lien payment plan

Check your Maryland tax liens. It ranges from 3-15 years depending on the state and resets each time you make a payment.

Monthly payments must be made.

. Individual Tax Forms Instructions. A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. The State Tax Sale Ombudsmans Office can refer homeowners to legal resources that may be able to help.

If you complete your return and you find you are unable to pay the taxes still file a tax return. You can send money in with your tax return. All Major Categories Covered.

Dont Let that Lien Hold Back Your Financial Future. Maryland tax lien payment plan. Or you can send.

Get Your Options Today. You can wait for a notice and pay with that voucher. The case began with a Montgomery County man Kenneth R.

Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. Tax Credits Exemptions. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov by calling the. You can apply for a Maryland state tax payment plan by indicating that. The Citys Finance Department and its Bureau of Revenue Collections want to assist the public by providing information about the tax sale where to obtain help if your property is eligible for tax.

In this article well explain what Maryland tax liens are how they work and how you can avoid or get rid of them. Default is person Person. Act Quickly to Resolve Your Tax Problems.

Ad IRS Interest Rates Have Increased. Ad Use our tax forgiveness calculator to estimate potential relief available. Maryland tax lien payment plan Friday February 25 2022 Edit.

Select the appropriate radio button to search cases by Person or Company. We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs 5 12 7 Notice Of Lien Preparation And. Ad IRS Interest Rates Have Increased.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Contact 1-800-MD TAXES 1-800-638-2937 or taxhelpmarylandtaxesgov. Act Quickly to Resolve Your Tax Problems.

Durations of 36 to 60 months are possible. The only way to get a tax lien released is to pay your Maryland tax balance. There are a few ways you can pay a Maryland tax debt.

Optima Tax Relief is BBB Accredited with an A Rating - Free Consultation. The rate of return in Maryland varies from 6 24 depending on the county. If you have additional questions please dont hesitate to contact the State Tax.

Trusted Methods Excellent Tax Team. Find Fresh Content Updated Daily For Maryland tax lien. On February 3 2015 the Court of Special Appeals reversed the Circuit Court ruling instead finding that judgment liens for taxes owed to Maryland are immune to the twelve-year.

If you do not know your notice number call our Collection Section at 410-974-2432 or 1-888-674-0016. Select Popular Legal Forms Packages of Any Category. After doing so you can visit the applicable circuit court to obtain a certified copy of the lien release.

Pay Your Taxes Today. Estimated Personal Income Tax. Pay these individual and business taxes here.

Many counties also have penalty rates included the return which positively affect the overall rate of return. Requests for payment plans should be made by the quarterly due dates of april 30 2022 july 31 2022 november 2 2022 and february 1 2023. Maryland tax lien payment plan Tuesday April 5 2022 Edit.

You will need your payment agreement number in order to set up an automatic payment. Maryland Tax Information for Seniors. Free Income Tax Preparation.

Ad Affordable Reliable. If you do not owe any taxes by April 15th you can request an extension to file a 502 503 505 or.

Frequency Content Creativity Your Value Proposition And You Value Proposition Estate Planning Attorney Marketing Program

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

What S The Most I Would Have To Repay The Irs Kff

Thoughtful Planning And Impeccable Execution Have Always Been Our Hallmark House Cost The Fox And The Hound Holiday Decor

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Experts Believe China Is Far From Uninterested In Cryptocurrency Despite Its Overt Efforts At Bans Of One Kind Or Anoth Cryptocurrency Bitcoin Bitcoin Currency

Fortunebuilders 3 Day Workshop Bonuses

Fortunebuilders 3 Day Workshop Bonuses

Owe The Irs Your Home Equity Could Help With Your 2021 Taxes

2022 State Tax Reform State Tax Relief Rebate Checks

Maryland Tax Payment Plan Tax Group Center

Estimated Income Tax Payments For 2023 And 2024 Pay Online

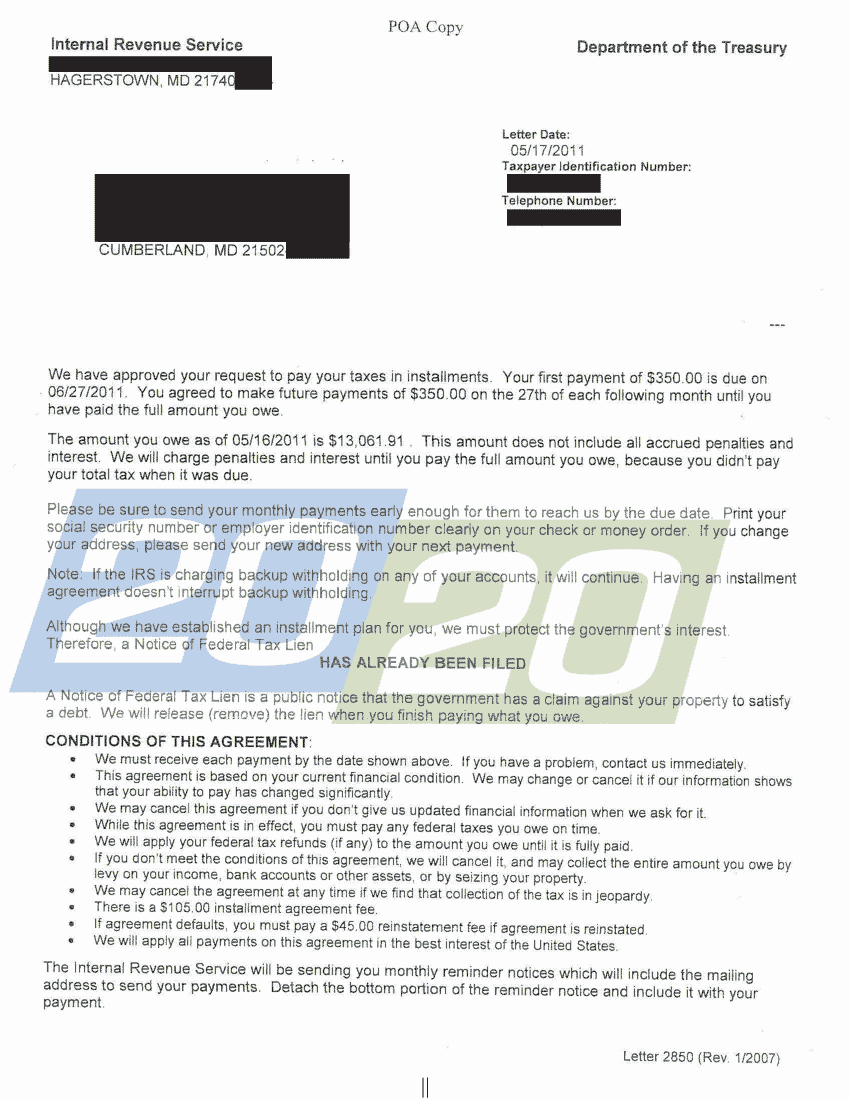

Irs Accepts Installment Agreement In Cumberland Md 20 20 Tax Resolution

How To Avoid A Maryland State Tax Lien

Maryland Comptroller And Irs Provide Tax Collection Relief In Response To Covid 19 Stein Sperling